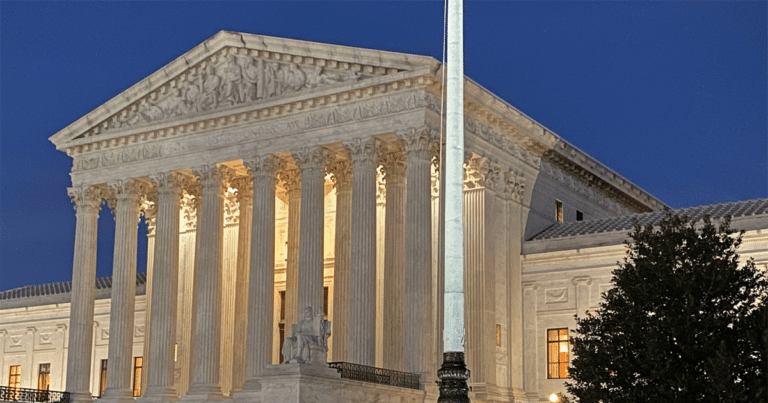

The Supreme Court has been instrumental in pushing back President Biden’s agenda. Decisions from the highest court in the land have rolled back major liberal initiatives, including gun control and abortion.

This has sparked calls from Democrats to pack the court with more justices, to erase the current conservative majority.

A new case has reached the court that directly touches on another Biden move. And how the court rules could affect the wealth of numerous Americans.

From The Hill:

At issue in Moore v. United States is the question of whether the federal government can tax certain types of “unrealized” gains, which are property like stocks or bonds that people own but from which they haven’t directly recouped the value, so they don’t have direct access to the money that the property is worth…“It’s the million-dollar question, just with a few more zeros: the quadrillion-dollar question,” Harvard University tax law professor Thomas Brennan told The Hill.

In recent years, Democrats and the Biden administration have been trying to tax Americans on “unrealized” gains. This means taxing you on money you don’t have, but it tied up in stocks and other investments.

Many have been heavily critical of this move, which could require Americans to pay much higher in taxes than what they are actually earning each year. So, this issue has been brought before the Supreme Court.

Rarely has any federal court ruled on the issue of taxation. And experts are divided on what “realized” gains in the tax code means.

But several possible outcomes might result from this case. The Supreme Court could side with Democrats and rule Americans have to pay taxes on money they do not have. That would result in major changes to the tax code and be a massive win for big government liberals.

Or the court could rule in favor of the American people and decide that “unrealized” gains cannot be taxed. That would save Americans billions of dollars, but expand the national deficit. Experts predict such a ruling would cost the government $340 billion over the next decade.

Not that most Americans would be upset about that. Biden has been frequently criticized for his aggressive spending agenda. And his U.S. solicitor will be arguing in favor of taxing “unrealized” gains before the court, showing just how important this issue is to Democrats.

Key Takeaways:

- The Supreme Court is hearing a case over taxes on “unrealized” gains.

- President Biden and Democrats want to tax Americans on money they do not have.

- How the court rules could either save taxpayers billions or give big government a huge win.

Source: The Hill